Contents

Due to the growing interest of investors, economists, and governments in Bitcoin, other cryptocurrencies began to be developed around 2017. The cryptocurrency has undergone several rallies and crashes since it became available. This article offers insight into Bitcoin’s volatility and some reasons why its price acts the way it does. Due to its pioneer status, a lot of investors view it as the crypto market’s reserve so other coins depend on its value to remain high. Because Bitcoin is decentralized and community-driven, many upgrades to Bitcoin come in the form of formal proposals called Bitcoin Improvement Proposals, or BIPs. This ensures that the software is always undergoing upgrades that can further contribute to the community’s needs.

Unlike fiat currencies, such as the Euro or the US-Dollar, the value of Bitcoin is not defined by a single entity like a central bank. Instead the price is defined by supply and demand, or in simpler terms, by the price people are willing to pay for it. Bitcoin is a reasonably liquid asset, and its liquidity is improving by huge percentages every year. Bitcoin is already much easier to transact with than gold, though less easy than fiat currency.

In September 2014, TeraExchange, LLC, received approval from the U.S.Commodity Futures Trading Commission “CFTC” to begin listing an over-the-counter swap product based on the price of a bitcoin. The CFTC swap product approval marks the first time a U.S. regulatory agency approved a bitcoin financial product. On 23 June 2013, it was reported that the US Drug Enforcement Administration listed 11.02 bitcoins as a seized asset in a United States Department of Justice seizure notice pursuant to 21 U.S.C. § 881. This marked the first time a government agency claimed to have seized bitcoin.

A variety of factors can influence the value of Bitcoin and other cryptocurrencies. Bitcoin’s value then is tied as much to how the network has evolved as to its code. Bitcoin will continue to fulfill the six characteristics of sound money because no one can change it so that it doesn’t. We recommend reading Parker Lewis’ article Bitcoin Can’t Be Copied4 on the Unchained Capital website to understand this point. Lewis explains why there’s more to money, specifically digital money, than just satisfying the six characteristics mentioned above. Scarcity – Currencies aren’t exempt from the law of supply and demand.

About Bitcoin

Bitcoin dropped below $23,000 for the first time since December 2020. The price started fluctuating more as uncertainty about inflation and the emergence of a new variant of COVID-19, Omicron, continued to spook investors. Bitcoin was designed to be used as currency in daily transactions. John Edwards is a licensed attorney with experience in commodities and investments. He provides performance analysis of hedge funds and investors. Bitcoin is secured with a Proof-of-Work mechanism, which means millions of miners work together to secure the decentralized network.

Stocks and commodities are more normally bought and held for longer. You might also pay a broker commission or fees when buying and selling assets direct and you’d need somewhere to store them safely. Note that algorithm-based price predictions can be wrong as they use past performance to inform their estimates. Always conduct your own due diligence before trading or investing, and never invest or trade money you cannot afford to lose.

When will the max supply be reached?

Eric has an MBA in finance from the University of Denver. Real estate and property, like precious metals, have a long history as a store of value. Land and certain objects (think famous paintings, historical documents, collectible comic books, etc.) have proven to hold their value well.

How many people are in FTC?

The Commission is headed by five Commissioners, nominated by the President and confirmed by the Senate, each serving a seven-year term.

To put a Satoshi into perspective, if bitcoin’s price were $1,000,000 per coin, a Satoshi would be worth just $0.01. In other words, for the foreseeable future, a single U.S. dollar will purchase hundreds of sats. Mt. Gox, the Japan-based exchange that in 2013 handled 70% of all worldwide bitcoin traffic, declared bankruptcy in February 2014, with bitcoins worth about $390 million missing, for https://cryptolisting.org/ unclear reasons. The CEO was eventually arrested and charged with embezzlement. On 12 March 2013, a bitcoin miner running version 0.8.0 of the bitcoin software created a large block that was considered invalid in version 0.7 . This split resulted in two separate transaction logs being formed without clear consensus, which allowed for the same funds to be spent differently on each chain.

Cryptocurrency supply and demand

It is the crypto market standard, benchmarking billions of dollars in registered financial products and pricing hundreds of millions in daily over-the-counter transactions. Built for replicability and reliability, in continuous operation since 2014, the XBX is relied upon by asset allocators, asset managers, market participants and exchanges. The XBX is the flagship in a portfolio of single- and multi-asset indices offered by CoinDesk. You may find that some exchanges list different bitcoin prices. This is because some exchanges operate independently of the open market and serve only their members, so prices may vary slightly from the overall market. Sometimes this is beneficial because you may be able to buy bitcoin without paying network fees, which may be more than the exchange’s fees.

- The real identity of Satoshi Nakamoto still remains a matter of dispute.

- Most nations still have central bank reserves that hold gold, along with other national currencies.

- Prior to the release of bitcoin, there were a number of digital cash technologies, starting with the issuer-based ecash protocols of David Chaum and Stefan Brands.

- To put a Satoshi into perspective, if bitcoin’s price were $1,000,000 per coin, a Satoshi would be worth just $0.01.

In August 2016, hackers stole some $72 million in customer bitcoin from the Hong Kong–based exchange Bitfinex. The US-based exchange Cryptsy declared bankruptcy in January 2016, ostensibly because of a 2014 hacking incident; the court-appointed receiver later alleged that Cryptsy’s CEO had stolen $3.3 million. The Slovenian exchange Bitstamp lost bitcoin worth $5.1 million to a hack in January 2015. In late August 2012, an operation titled Bitcoin Savings and Trust was shut down by the owner, leaving around US$5.6 million in bitcoin-based debts; this led to allegations that the operation was a Ponzi scheme.

The fee is awarded to whichever miner adds the transaction to a new block. Fees work on a first-price auction system, where the higher the fee attached to the transaction, the more likely a miner will process that transaction first. For more information on digital asset risk see FINRA, SEC, and CFPB public advisories. SoFi will apply a markup of up to 1.25% for each crypto transaction. Eric Rosenberg is a financial writer with more than a decade of experience working in banking and corporate accounting. He specializes in writing about cryptocurrencies, investing and banking among other personal finance topics.

What will bitcoin be worth in 2030?

Faucets usually give fractions of a bitcoin, but the amount will typically fluctuate according to the value of bitcoin. To reduce mining fees, faucets normally save up these small individual payments in their own ledgers, which then add up to make a larger payment that is sent to a user’s bitcoin address. On 2 July 2020, the Indian company 69 Shares started to quote a set of bitcoin exchange-traded products on the Xetra trading system of the Deutsche Boerse.

Forcing a transaction is impossible because they would have to control 51% of all miners. Because Bitcoin is decentralized, it is not subjected to inflation or any monetary policies created by any central banks or government. Instead, there will only ever be 21 million BTC in existence. The percent change in trading volume for this asset compared to 1 hour ago. Over the 10 years ended 1 July 2021, Bitcoin’s price grew at a compound annual growth rate of 116.41%.

Figures like these make Bitcoin worth consideration from any serious investor. In 2014, Adam Back, another cypherpunk and the inventor of Hashcash – a cryptographic hashing algorithm created in 1997 which used the same proof-of-work mechanism that Bitcoin would later adopt – co-founded Blockstream. Blockstream is a for-profit tech company that develops new infrastructure on the Bitcoin network, including Lightning Network and sidechains. There were also a range of other developers including Pieter Wuille and Peter Todd who contributed to the development of Bitcoin Core – the first client on the Bitcoin network. A client is a piece of software that enables a network participant to run a node and connect to the blockchain. The material provided on this website is for information purposes only and should not be understood as an investment advice.

People Also Ask: Other Questions About Bitcoin

The first proposals for distributed digital scarcity-based cryptocurrencies were Wei Dai’s b-money and Nick Szabo’s bit gold. Hal Finney developed reusable proof of work using hashcash as its proof of work algorithm. Kimchi premium is the gap in cryptocurrency prices, notably bitcoin, in South Korean exchanges compared to foreign exchanges.

A nugget of gold has value, and a coin struck from that nugget holds value in a different form. Institutions that issue money made from commodities rely on it to maintain its value because of the underlying commodity. Gold coins are worth money first of all because they’re gold and only secondarily because a certain government or bank issues them. Essentially, all forms of commodity money are valuable not because you can exchange them for goods or services, but because they have some form of utility in and of themselves. In July 2011, the operator of Bitomat, the third-largest bitcoin exchange, announced that he had lost access to his wallet.dat file with about 17,000 bitcoins (roughly equivalent to US$220,000 at that time). He announced that he would sell the service for the missing amount, aiming to use funds from the sale to refund his customers.

There are many reasons to be interested in Bitcoin – and we outline the most common ones here – but it is undeniably the price that attracts the most attention. This is natural because value of quarkcoin people are always looking for ways to grow their wealth. Bitcoin total supply will never exceed 21 million bitcoin. There will never be more than 21 million bitcoin in existence.

How long does it take for FTC to respond?

How long does it take for the FTC to respond to a FOIA request? Our goal is to respond within the timeframe outlined in the Freedom of Information Act, which is twenty working days, or approximately one month, but this may vary with the complexity of the request.

Bitcoin is a cryptocurrency designed to be used as a payment method. Investors and traders began using it as an investment, as well, but its price is very volatile. It is best to talk to a professional financial advisor about your circumstances and goals before buying Bitcoin as an investment. Lastly, if consumers and investors believe that other coins will prove to be more valuable than Bitcoin, demand will fall, taking prices with it. Or, demand will rise along with prices if sentiment and trading move in the opposite direction. While Bitcoin is still a cryptocurrency, investors have also used it to store value and to hedge against inflation and market uncertainty.

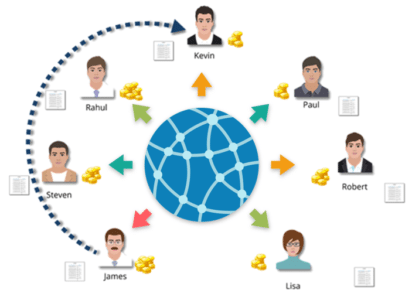

The same supply and demand principle applies to cryptocurrencies. Cryptocurrency gains value when demand rises higher than supply. In November 2013, the University of Nicosia announced that it would be accepting bitcoin as payment for tuition fees, with the university’s chief financial officer calling it the “gold of tomorrow”. During November 2013, the China-based bitcoin exchange BTC China overtook the Japan-based Mt. Gox and the Europe-based Bitstamp to become the largest bitcoin trading exchange by trade volume. The cryptocurrency gained mainstream traction as a means of exchange. It also attracted traders who began to bet against its price changes.

As of 2021, the Bitcoin network consumes about 93 terawatt hours of electricity per year – around the same energy consumed by the 34th-largest country in the world. Whoever successfully unlocks the next block is rewarded with a set number of bitcoin known as “block rewards” and gets to add a number of transactions to the new block. They also earn any transaction fees attached to the transactions they add to the new block. A new block is discovered roughly once every 10 minutes. Bitcoin transactions are recorded on a public, distributed ledger known as a “blockchain” that anyone can download and help maintain.

“When the whole industry will be more transparent and regulated, we are expecting to see new money coming into the market. Bitcoin has managed to move far beyond being a peer-to-peer version of electronic cash to becoming a store of value and a hedge against inflation. To check Bitcoin’s price live in the fiat currency of your choice, you can use Crypto.com’s converter feature in the top-right corner of this page. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

Bitcoin’s price history can be analyzed with many of the techniques used by brokers and investors to analyze stock performance. Government agencies, economists, and journalists began taking Bitcoin seriously, though most of the financial establishment remained skeptical. Editorials appeared in business journals whenever the Bitcoin exchange rate changed. Kraken has agreed to shut its cryptocurrency-staking operations to settle charges with the U.S.