Contents

FXCM has low trading costs overall and no withdrawal, account, or deposit fees. However, the other fees are average, and there is an inactivity fee for accounts that have been idle for a year or more. There are no account, deposit, or credit/debit card withdrawal fees. However, you have to pay a $50 fee after one year of inactivity and bank withdrawal can be costly. FXCM offers only one account type for retail traders which is further divided into standard status or active trader status.

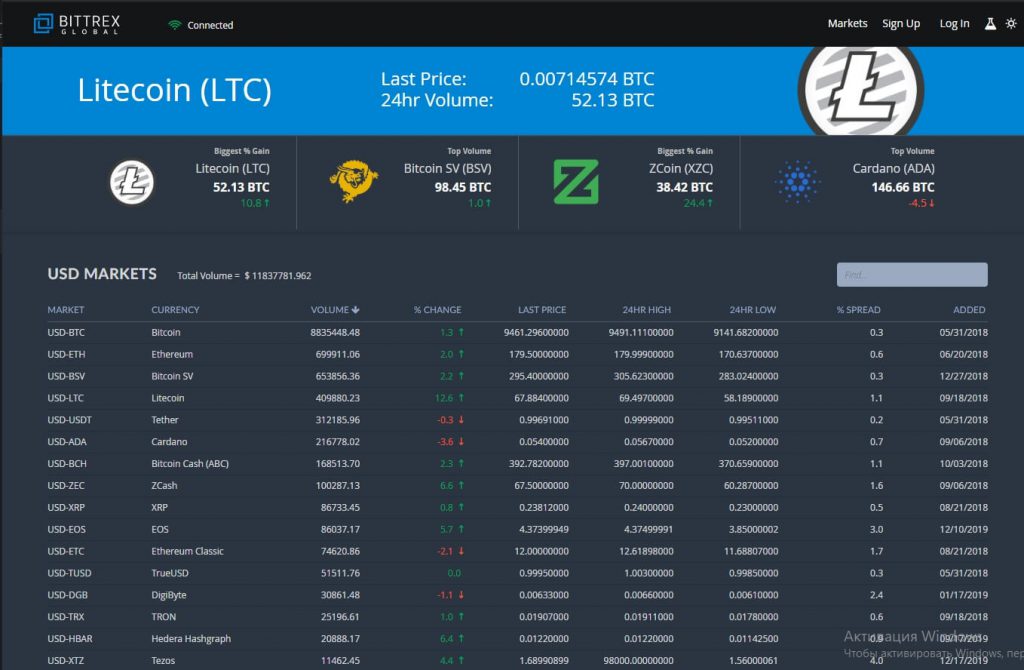

Here is a screenshot of the FXCM Trading Station platform during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads. The news feed is very good and users can also use an economic calendar. That way, users can specify what they are interested in, and receive news accordingly. FXCM’s daily newsletter, Before the Bell, provides helpful info and daily trading ideas based on the market analysis of FXCM’s experts. The education is outstanding and users can also get a demo account with £50,000 of virtual money.

We recommend the users to reset their password for safety reasons. During our analysis for this review, the official website claimed to support over 39 Forex pairs and feature Forex spot trading. At FXCM, a total of 82 CFDs are offered along with cryptocurrencies, commodity CFDs. Readers are advised to note that the broker supports the trading of cryptocurrency as CFDs rather than actuals. Once the application is processed and approved, the new user will receive a username and password to access the MyFXCM portal, where they can deposit funds to start trading CFDs and Forex. All financial transactions occur in the secure back office of FXCM, MyFXCM. The deposit and withdrawal options offered by the Bermuda subsidiary are the best, while others offer limited choices.

For UK and EU traders only, the FXCM demo account functions like the live trading platform, except that traders are given £50,000 practice credits to test out the functionalities of the platform. Commissions and fees are generally excellent for low-cost trading at FXCM. You will find that they generally don’t charge commission on trading with any of their account types of assets and so, you just have to consider the spread and any non-trading fees. 67% of retail investor accounts lose money when trading CFDs with this provider. The range of products available to you will depend on the entity of your trading account. Cryptocurrency trading is available at FXCM through CFDs, but not available through exchange trading the underlying asset.

GLOBAL FOREX AWARDS 2022 Most Transparent Forex Broker – Global

Namely, the company offered its users a no dealing desk platform and gave them misleading information that damaged their trades. There are multiple platforms, some of which offer social/copy trading and algorithmic trading capabilities. At BrokerChooser, we consider clarity and transparency as core values. BrokerChooser is free to use for everyone, but earns a commission from some of its partners with no additional cost to you . Réka attended the International Business and Economics bachelor program at Corvinus University in Budapest.

These cover topics ranging from trading basics to platform tips and tricks. FXCM provides free phone support for the residents of 42 countries. This shows whether you https://forex-reviews.org/ should buy or sell, based on technical indicators like RSI or MACD. There areclear portfolio and fee reports on the ‘Reports’ tab of the platform and at MyFXCM.

FXCM UK Customer Service

With the help of the FXCM support team, traders can also develop their very own MT4 Expert Advisors. FXCM offers users a near-flawless educational experience that includes training videos, webinars, written content, as well as a demo account with £50,000 of virtual money. The company offers a bundle of great basic forex training lessons, and a considerable video archive full of well-produced, high-quality video lessons. FXCM has different fee structures depending on the account type. Retail account holders don’t pay commissions on most trades, while active trader accounts and professional accounts do.

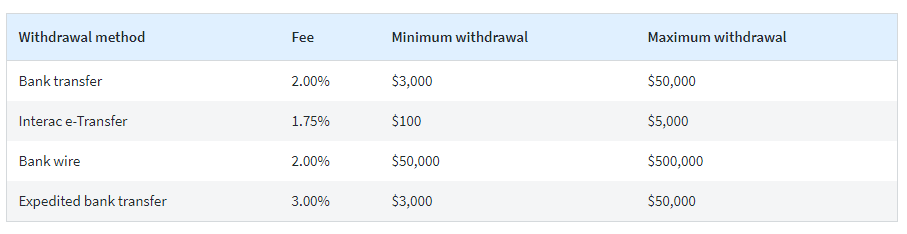

FXCM processes withdrawal requests within two business days. For your withdrawal request to proceed you’ll have to wait 3 to 4 business days. Yes, FXCM does charge a $50 inactivity fee after one year of inactivity. If this is not your first deposit the minimum is also $50 and there is no minimum if you deposit via wire transfer. The selection of investment products is quite poor when compared to the competition.

The CFD account allows traders to gain access to the markets through the derivative CFDs. Most brokers display their spreads in a simple format, whereas going through FXCMs website – they do state the impact of effective spreads but don’t display an average “expected” spread of any of the assets. According to FXCM’s slippage report, traders received better spreads or zero slippage 85% of the time. Many brokers are able to provide a variety of educational resources such as video courses, seminars, e-books, related articles, glossaries that provide some basic knowledge about trading. Using the username and password shared by the FXCM customer service team, the new users can access their accounts.

FXCM Alternative Brokers & Comparisons

This has enabled us to select the best solutions to fulfill our clients’ needs. The integration means that FXCM users will be able to execute orders directly from… Overall, FXCM fits the needs of traders at all levels of expertise. The online broker even provides wholesale trade execution and liquidity solutions for retail forex brokers, smaller hedge funds and emerging markets banks through its FXCM Pro service.

- The 1st tier ranges from $10 to $25 million traded per month and pays $5 per million, while the 5th tier pays $25 per million if you traded a minimum notional amount of $300 million per month.

- Professional account holders do not have negative balance protection, leverage limits, and risk warnings.

- BrokerChooser is free to use for everyone, but earns a commission from some of its partners with no additional cost to you .

- FXCM also offers an API product under ‘FXCM Pro’ aimed at institutional clients wanting to exercise wholesale trading execution.

- The minimum deposit at FXCM UK is £50 for all payment methods and account types.

Opening an FXCM demo account allows you to test out FXCM’s service without risking or depositing any of your money. With this comes greater benefits through trading fees, spreads, and institutional derived trade ideas through their premium eFXplus research site. There is no point fixating on the spreads; if you are interested in FXCM, you can review their forex pairs here and click on each asset to see the current, real-time spread. And to help you find the best trading platform there are a lot of brokers that are looking to take their place in the forex market.

Mobile trading platform

You should be aware that you may lose a significant portion of your portfolio. FXCM offers support via business hours, 24/7 live support, and online. Forex Capital Markets is an award-winning broker that has gained acknowledgement throughout the industry. It has a long list of awards and recognitions for its performance as a broker and services related to trading. Overall, we ranked FXCM Deposits and Withdrawals 8 out of 10. The fees are either very little or no fees at all depending on the entity.

The 1st tier ranges from $10 to $25 million traded per month and pays $5 per million, while the 5th tier pays $25 per million if you traded a minimum notional amount of $300 million per month. Spot opportunities, trade and manage your positions from a full suite of mobile and tablet apps. Click below to consent to the above or make granular choices. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen. All website content is published for educational and informational purposes only.

Global Forex Awards 2020 Best Forex Trading Platform – Global

Only the Bermuda subsidiary supports them, while all others have fewer options. I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability. See how FXCM compares to the leading Forex brokers by reading one of the reviews below. FXCM has a history of fraudulent business practices that lasted from 2009 to 2014.

Step 2) Select your country of residence and choose your preferred trading platform, then click ‘BEGIN APPLICATION’. More, the top bar shows which trading server traders are connected to, as well as a customizable layout setting. FXCM also offers an API product under ‘FXCM Pro’ aimed at institutional clients wanting to exercise wholesale trading execution. On November 10, 2017, Global Brokerage Inc., a publicly-traded company on the US NASDAQ exchange, announced a reorganization bankruptcy plan under Chapter 11. Global Brokerage Inc., through a subsidiary, owns a majority stake in FXCM. FXCM then is an ideal broker choice at any step of your trading journey and the sheer size of this industry leader makes them huge accessible for you to start trading from almost anywhere in the world.

This happened because FXCM had a relationship with an important market maker at the time. This concealed relationship led to a conflict of interest between FXCM and its users, which resulted in users losing money. The prices and fees are well below average and there are discounts for high-volume trading. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

In the sections below, you will find the most relevant fees of FXCM for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates. Non-trading fees include charges not directly related to trading, like withdrawal fees or fxcm review inactivity fees. No response from us regarding your deposit and withdrawals does not sound like FXCM at all and we really wanted to learn more about your case. We had a quick check but unfortunately not able to locate any account under your name that encounters with the issue you are mentioning about.

Trading in any type of financial product including forex, CFDs, stocks, and cryptocurrencies. The owner of this website may be compensated to provide opinions on products, services, websites and various other topics. Even though the owner of this website receives compensation for our posts or advertisements, we always give our honest opinions, findings, beliefs, or experiences on those topics or products. The views and opinions expressed on this website are purely the author. Any product claim, statistic, quote or other representation about a product or service should be verified with the manufacturer, provider or party in question. This risk is higher with Cryptocurrencies due to markets being decentralized and non-regulated.

What you need to keep an eye on are trading fees and non-trading fees. To read much more details about the broker’s services and features, expand on the sections below. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active.

Islamic Accounts are swap-free (interest-free) and do not pay any swap fees whenever they keep a position open beyond the market closing time. Active Traders pay commission fees of $50 to $60 round turn per million worth of trade. Note that the spread fees for Islamic Accounts are higher because they pay no interest. The mobile app also allows users to create entry orders, where traders have to define the amount, the rate, stop/loss limit, and trade type. The trading window requires all traders to select and confirm as to which account to trade with , the asset being traded, the amount, and the order type . Following a simple sign-up using their personal details and a handful of questions, traders have full access to the platform.

Within this area, you will find helpful guides, tutorials, blog posts, and regular webinars covering every aspect of the broker and trading in general. It is clear FXCM recognizes the importance of education and has put together an impressive area to service this need. At the core of this trusted broker is the regulation they have in place. This comes from multiple top-tier bodies including the FCA in the UK, ASIC in Australia, and the FSCA in South Africa as well as the IIROC in Canada. This level of compliance around the world shows the FXCM commitment to trader security and providing the safest possible venue for you to trade.

There is a single account at FXCM you are able to trade a range of trading instruments that are included in the offering. Based on our Expert finds, FXCM provides great trading conditions for Forex and CFDs. They offer a global platform that is suitable to trade internationally, including European clients as well as beginning traders looking for technical solutions. On the negative side, which we think are not so many, there is a withdrawal fee for Bank Wire transfers in some regions and the support is not available on a 24/7 basis. Also, the broker might not be suitable for futures and options traders due to the lack of these assets. If you want to start practicing without making a deposit, you can open up a free demo account.

FXCM Group is owned by Leucadia Investments, one of the Jefferies Financial Group’s merchant banking arms, and has a strong background in investment banking and is also listed on the New York Stock Exchange. 74.74% of retail investor accounts lose money when trading CFDs with FXCM. FXCM provides traders with its proprietary Trading Station, the MT4 trading platform and ZuluTrade. It also maintains six specialty trading platforms for algorithmic traders and Capitalise AI.