Contents:

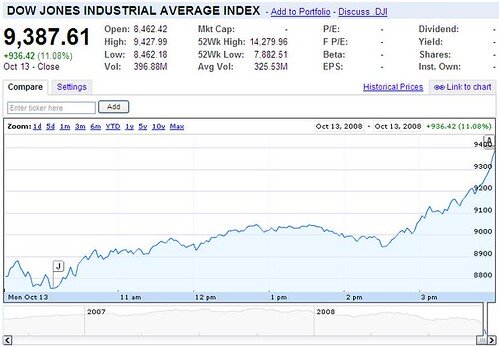

Additionally, a full breakout doesn’t always happen, or instead, false breakouts occur multiple times before the pattern is actually broken, and a continuation or reversal occurs. Continuation patterns occur in the middle of a prevailing trend, indicating that the price action will likely resume in the same direction even after the continuation pattern completes. However, not all continuation patterns will result in the continuation of the trend — many will also result in reversals. The triangle pattern usually occurs in trends and acts as acontinuation pattern. The statistics on the price action patterns below were accumulated through testing of 10 years of data and over 200,000 patterns.

Chart patterns can indicate whether this rising price trend is about to switch course and start going down or continue in the same direction. Typically, trading volume will decrease during the pattern formation, followed by a significant increase during the breakout. The double top/bottom is one of the most commonreversal price patterns. The double top is defined by two nearly equal highs with some space between the touches, while a double bottom is created from two nearly equal lows. Generally, the wider the gap between touches the more powerful the pattern becomes.

A bull flag resembles the letter F, just like the double top pattern looks like an “M” letter and a double bottom pattern – a Wletter. Once you entry a flag pattern, the targets can be derived from many indicators. The initial targets on all flag patterns will be the high or low of the flagpole. If the flagpole price peak is exceeded, then you can use Bollinger Bands and or fib price levels. To get fib price level targets, first plot the high to low and low back to high price levels of the flagpole. This should not only give the fib retracement levels but also the fib extension levels.

What is the bear flag pattern?

All in all, chart patterns are helpful technical indicators that can assist traders in how or why a security’s price has moved in a certain way and how its price might behave in the future. This is particularly helpful for identifying profitable entry and exit points or setting up stop-loss levels. The pennant pattern is one that you often see right next to the bull and bear flag pattern in the textbooks, but rarely does anyone talk about its low success rate. While the flag itself isn’t an exceptional pattern at just under a 70% success rate, the pennants come in well below that. As with Flags, there are two types of Pennants – bullish Pennant and bearish Pennant.

A breakout to the upside activates the pattern, while a break of the supporting line invalidates the formation. Even if you’re sure that your flag is going to see a continuation, it’s always worth paying attention to risk management as part of your strategy. In a downtrend a bear flag will highlight a slow consolidation higher after an aggressive move lower.

By https://trading-market.org/ing these patterns and using them to form trading strategies, investors can increase their chances of maximizing profits while minimizing potential losses. However, it’s important to remember that no trading strategy is foolproof and that there is always a risk involved when trading in the cryptocurrency market. As such, it’s important to do your own research and exercise caution.

The target for a bull flag is derived by measuring the length of the flag pole and projecting it from the breakout point. To survive in trading forex, you should learn to trade with logic. There is always some logic behind every chart pattern or every trading strategy. You cannot master a trading strategy until you will learn the logic behind it. Triple tops and bottoms are reversal chart patterns that act similarly to double tops and bottoms, consisting of three peaks or bottoms , respectively. Trading volume plays a vital role in these patterns, often declining during the formation and increasing as the price breaks out of the pattern.

How to Buy Lucid Motors Stock (LCID)? Step-by-Step

There are many options for protecting this type of trade with a stop loss. Longer-term traders often set their stops below the entire flag, and other traders employ tighter stops such as a two-bar stop. It will draw real-time zones that show you where the price is likely to test in the future. Due to their popularity and easy visibility, rectangles are highly susceptible to false breakouts.

The bull flag pattern is a piece of price action that occurs on candlestick charts after a major upward move. In a bullish flag pattern, the market consolidates between two parallel lines of support and resistance, before eventually breaking out through resistance and resuming the original uptrend. A bull flag pattern is a technical analysis term that resembles a flag. It is considered a bullish flag pattern because it generally forms during an uptrend. The “flag” part of the pattern forms when the price consolidates sideways after a sharp rally. This consolidation usually takes the form of a small rectangle.

Advantages and disadvantages of bull flag pattern

And, this appearance makes it a user-friendly, easy-to-identify chart pattern. It’s crucial to be careful when identifying the bullish flag in the chart and when you trade the bull flag — several important factors must be present to form this pattern. When looking at the flag on smaller time intervals, traders risk making mistakes in setting the stop-loss – the bullish flag sometimes gives false breakout point signals. Therefore it’s crucial to continuously educate yourself and seek independent advice if necessary.

The triple top is defined by three nearly equal highs with some space between the touches, while a triple bottom is created from three nearly equal lows. The Flag pattern is one of the most popular continuation patterns. The end of the trade would come when the GBP/USD price breaks the third Stop Loss order (S/L 3). As you see, the price reverses afterward, which would have created unpleasant conditions for the long trade.

The support line connects the lower highs, and the resistance line is drawn, connecting the higher lows. However, one from the lower trendline signifies the beginning of a new downward trend, while a breakout from the upper trendline marks the start of a new upward trend. The bull flag formation is a technical analysis pattern that resembles a flag. The flag is considered to be a continuation pattern, which means that it forms during an uptrend and indicates that the trend will continue once the pattern is complete. Traders of bull and bear flag patterns might hope to see the breakout accompanied by a high-volume bar. A high-volume bar to accompany the breakout, suggests a strong force in the move which shifts the price out of consolidation and into a renewed trend.

What is the pennant pattern?

All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. One useful way to confirm a flag is to watch the market’s volume. In a bullish flag, volume should be high during the initial uptrend, then peter out as the market consolidates.

The image illustrates how you would perform your analysis to arrive at a potential trading opportunity. You will see the red Flag Pole and the blue Flag channel on the chart. When you open your Flag trade, you put a stop loss below the extreme point of the Flag. When the price increases and completes the size of the Flag, you can close out 1/3 of your position size and book the profits. The take profit for the Flag pattern should be addressed using the two targets we discussed earlier. However, I would suggest taking profits at each target level to reduce risk and book profits.

The rectangle price pattern is acontinuation patternthat follows a trending move. It is very similar to the channel pattern, except that the pattern does not have a slope against the preceding trend which gives it a higher chance of successful continuation. The buy signal on this chart comes when the price action creates a bullish breakout through the upper level of the pennant.

You can see that the market touched exactly this level, and then slightly corrected lower, which most likely points to take-profit orders of the bull flag being hit. Our entry is located either at the close of the breakout hourly candle, or we wait for a retest, which can be tricky as the price action may never return to retest the broken resistance. In this example, we enter the market as soon as the breakout candles close above the flag’s resistance.

Missoula Police Discover 421 Fentanyl Pills, 36 Grams of Meth – Newstalkkgvo

Missoula Police Discover 421 Fentanyl Pills, 36 Grams of Meth.

Posted: Mon, 17 Apr 2023 22:38:58 GMT [source]

The sharper the spike on the flagpole, the more powerful the bull flag can be. A flag can be used as an entry pattern for the continuation of an established trend. The formation usually occurs after a strong trending move that can contain gaps where the flag represents a relatively short period of indecision.

This is identified as a period of consolidation after the completion of prices initial decline. During this period, prices may slowly channel upward and retrace a portion of the initial move. At this point traders will wait for price to break to lower lows in the direction of the trend.

How a Flag Pattern Works

The flag, which represents a consolidation and slow pullback from the uptrend, should ideally have low or declining volume into its formation. This shows less buying enthusiasm into the counter trend move. In an uptrend a bull flag will highlight a slow consolidation lower after an aggressive move higher.

African swine fever virus I73R is a critical virulence-related gene: A … – pnas.org

African swine fever virus I73R is a critical virulence-related gene: A ….

Posted: Thu, 06 Apr 2023 18:07:07 GMT [source]

Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

The high tight flag is considered to be one of the most bullish chart patterns that a stock can form. This is because it requires such a strong move higher to form the initial part of the pattern which shows very strong institutional demand for the stock. This huge advance in price then consolidates near highs without giving much progress back which tells us that even though it just had a massive move higher, nobody is interested in selling yet. Overall, the pattern is considered to be a formidable pattern to trade, as long as all elements are in place.

- Although flags are very simple classical chart patterns, they provide an extremely accurate prediction of the next price movement.

- To survive in trading forex, you should learn to trade with logic.

- Using the second trendline stop-loss may be more costly but it avoids wiggles at the first trendline from triggering premature stops.

- The exit target price is similarly easy to identify by the length of the flag pole.

- Furthermore, patterns can also be subjective, as what one trader perceives as a pattern is not always how another trader would see or draw them in real time.

- Notice the bullish Flag pattern starts with a bullish Flag Pole, which turns into a bearish correction.

If the price has gone up far, don’t expect a pullback to the support level. In this case, it is more efficient to trade using the momentum breakout method. Trading with the market is aimed at minimizing risks and making a buy trade at a better price during the breakout of the resistance line. Downward consolidation develops next, which is represented by the bull flags structure itself.

Like other chat bull flag formations, the flag pattern has its unique key features. Below is a detailed analysis of the main advantages and disadvantages of the bullish flag. In the picture above you can see the EURUSDForex trading pair with clearly visible elements of the bullish flag pattern.